Turnover certificate is a factual statement, confirming the total turnover of your business for a specific period. This document can be issued by a Chartered Accountant only. It includes the applicant's organisation’s entire annual turnover. It works as a declaration or a proof of accurate turnover. To get your certificate, connect with Bizfoc.

We provide a turnover certificate from qualified CA in Jammu & Kashmir who is experienced in this field and at very reasonable charges. Know about its fee structure, information required, process, etc in detail.

Turnover Certificate is a stamp approved by a Chartered Accountant to certifies the total turnover of an entity for a specific period. This certificate works as a proof that the entity has achieved the turnover amount mentioned in the certificate. It shows details of turnover based on either IncomeTax Return or GST returns or audit reports , as applicable. The duration of these certificates range from one year to multiple years, depending on your requirements. It is asked by banks while applying for loans, government for tender and many other purposes. This transfer is made under the applicant’s organisation’s entire annual turnover. Only a qualified Chartered Accountant can issue and certify a Turnover Certificate.

If you want a turnover certificate, you need to consult with a Chartered Accountant. Only a Chartered Accountant can issue and certify it. Bizfoc has a professional team of CA who have multiple years of experience in certifying this Certificate. We offer this Certificate at the most affordable price. Make sure you have enough and complete information while applying for this Certificate.

For obtaining a Turnover Certificate one need to gather following information:

To get a Turnover Certificate from qualified CA, one needs to follow certain steps. These steps are not much difficult but will be advised to do under professional vision. Following are the steps as follow:

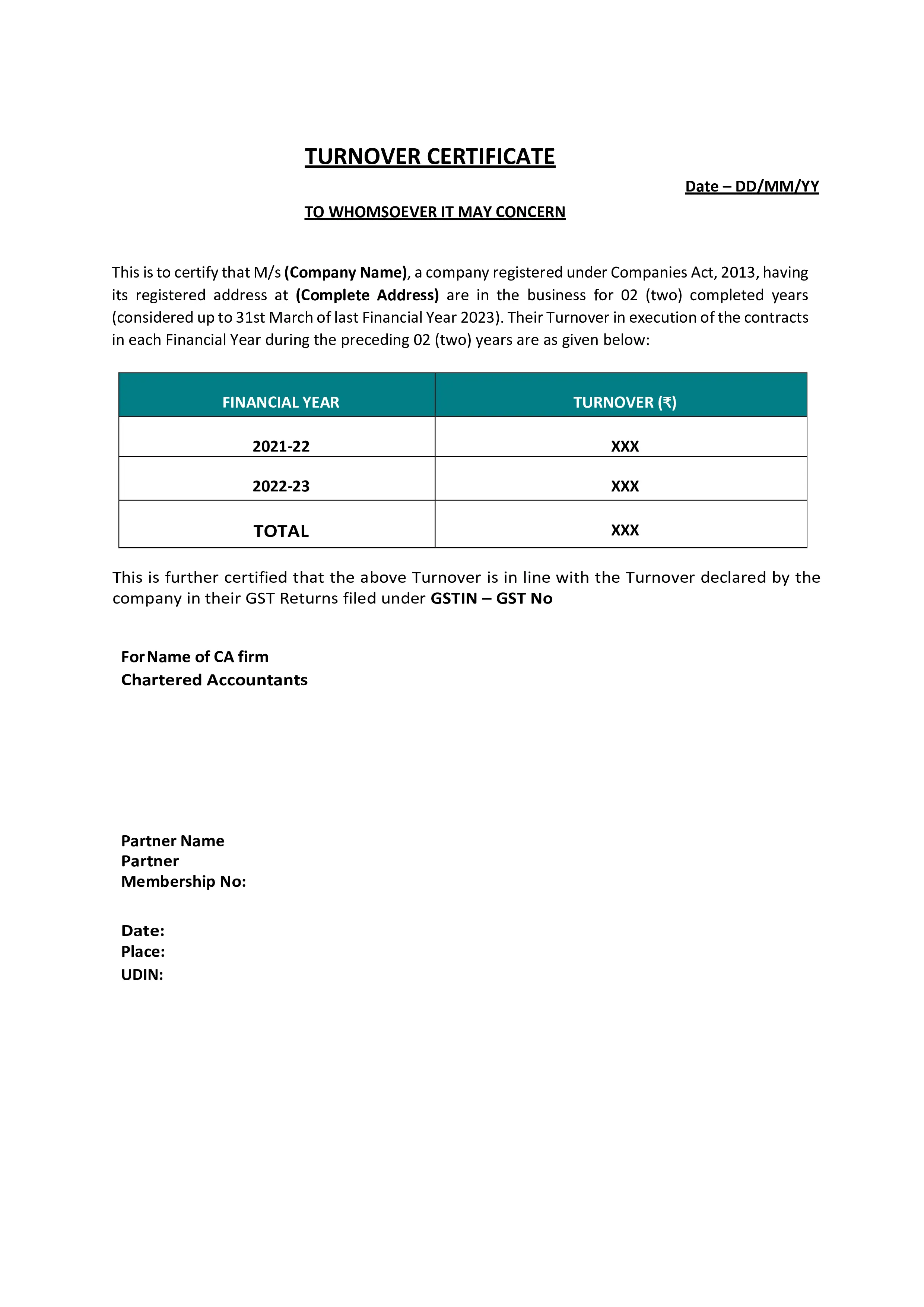

Following is the format for Turnover Certificate, you can read it in detail to get a better understanding related to it.

Date – DD/MM/YY

TO WHOMSOEVER IT MAY CONCERN

This is to certify that M/s (Company Name), a company registered under Companies Act, 2013, having its registered address at (Complete Address) are in the business for 02 (two) completed years (considered up to 31st March of last Financial Year 2023). Their Turnover in execution of the contracts in each Financial Year during the preceding 02 (two) years are as given below:

|

FINANCIAL YEAR |

TURNOVER (₹) |

|

2021-22 |

XXX |

|

2022-23 |

XXX |

|

TOTAL |

XXX |

This is further certified that the above Turnover is in line with the Turnover declared by the company in their GST Returns filed under GSTIN – GST No

For Name of CA firm

Chartered Accountants

Partner Name

Partner

Membership No:

Date:

Place:

UDIN:

The fee for the Certificate depends on the Chartered Accountant. However, it usually lies between the range of ₹1000/- to ₹2000/-. You can get your certificate with Bizfoc at the most affordable price compared to others. As we at Bizfoc believe client satisfaction is our motto so, we offer a turnover certificate at just ₹1499/-.

Bizfoc believes its clients satisfaction is on top, we provide a hustle free procedure so you can get your certificate within time and at an affordable price. Bizfoc has a professional team of CA with multiple years of experience who will assist you during the filling process and even after the filing. You can connect with Bizfoc to get your certificate.

A turnover certificate is a document which is issued by a chartered accountant. It includes the applicant's organisation’s entire annual turnover. It is required for loan application, investment purpose, opening current account, tender purposes, export business, etc. One can get this certificate at just ₹1000/- to ₹2000/- depending on the Chartered Accountant fees. Several information is required while applying for it such as name and details of organisation for which it will be issued, period & purpose of the certificate, UDIN, etc.

It is a document confirming the total turnover of an entity for a specific period.

It is needed for various purposes such as loan application, investment purposes, opening current account, tender purposes, export business, etc.

The fee for the certificate can range between ₹1000/- to ₹2000/- depending on the Chartered Accountant.

It can be issued only by a qualified Chartered Accountant.

The basic information required includes the name and details of the business entity, period & purpose for it, UDIN, etc.