While applying for loan or credit, banks ask for a networth certificate as it shows the ability of the borrowers to repay the loan amount. Networth Certificate works as an essential document while applying for loan. Without this certificate, applying for a loan may seem difficult. One can get their certificate by consulting with a chartered accountant. This certificate works as a proof while applying for a loan. Read this article to know every requirement to obtain a networth certificate for a bank loan.

A networth certificate is an official document certified by a chartered accountant. It helps in many processes such as to obtain bank loans, credit, VISA, etc. It should be recommended while applying, one should hire an experienced chartered accountant or consultant team to get their certificate. Networth Certificate requires certain documents or information while applying for it. It can be obtained within 24 hours with Bizfoc. This certificate needs complete details of assets or liabilities. It can mislead the certificate if individuals hide their net worth. While applying for a loan, it fastens the speed of the process.

While applying for bank loans, banks ask for a networth certificate. Following are the reasons why it is needed:

There is no other income or debts and hence it is required to generate your certificate from a trustworthy organisation.

There are certain documents required for a networth certificate. These documents includes:

The fee for Networth Certificate is just ₹2500/-. One can get their certificate by paying this amount and fulfilling other documentation processes. However, this certificate is required for various purposes other than bank loan such as while applying for visa, demat account opening, etc.

To apply for a networth certificate for bank loan, one need to follow these steps:

A Networth Certificate for a bank loan can be certified by a chartered accountant only. No one other than a chartered accountant can issue a networth certificate for a bank loan. To get an authentic networth certificate, you should consult with a genuine organisation. Bizfoc have great reputation in dealing with networth certificate.

The first step in this procedure is to convert into a normal company. For this purpose, the applicant company has to submit an application to the MCA along with the documents mentioned above.

Once receiving the application and the documents, the authorities must do legal checks and ensure compliance under the governing legislation.

An approval is granted by the MCA for the conversion of the applicant company if they do not find any errors or any kind of mismatch during the verification of documents.

After conversion, the formalities for the procedure of strike off are addressed by the applicant. The applicant of the application needs to submit the application to the MCA along with the necessary documents and required fees.

After verification of the application and the supportive documents, approval for the strike-off is granted to the company.

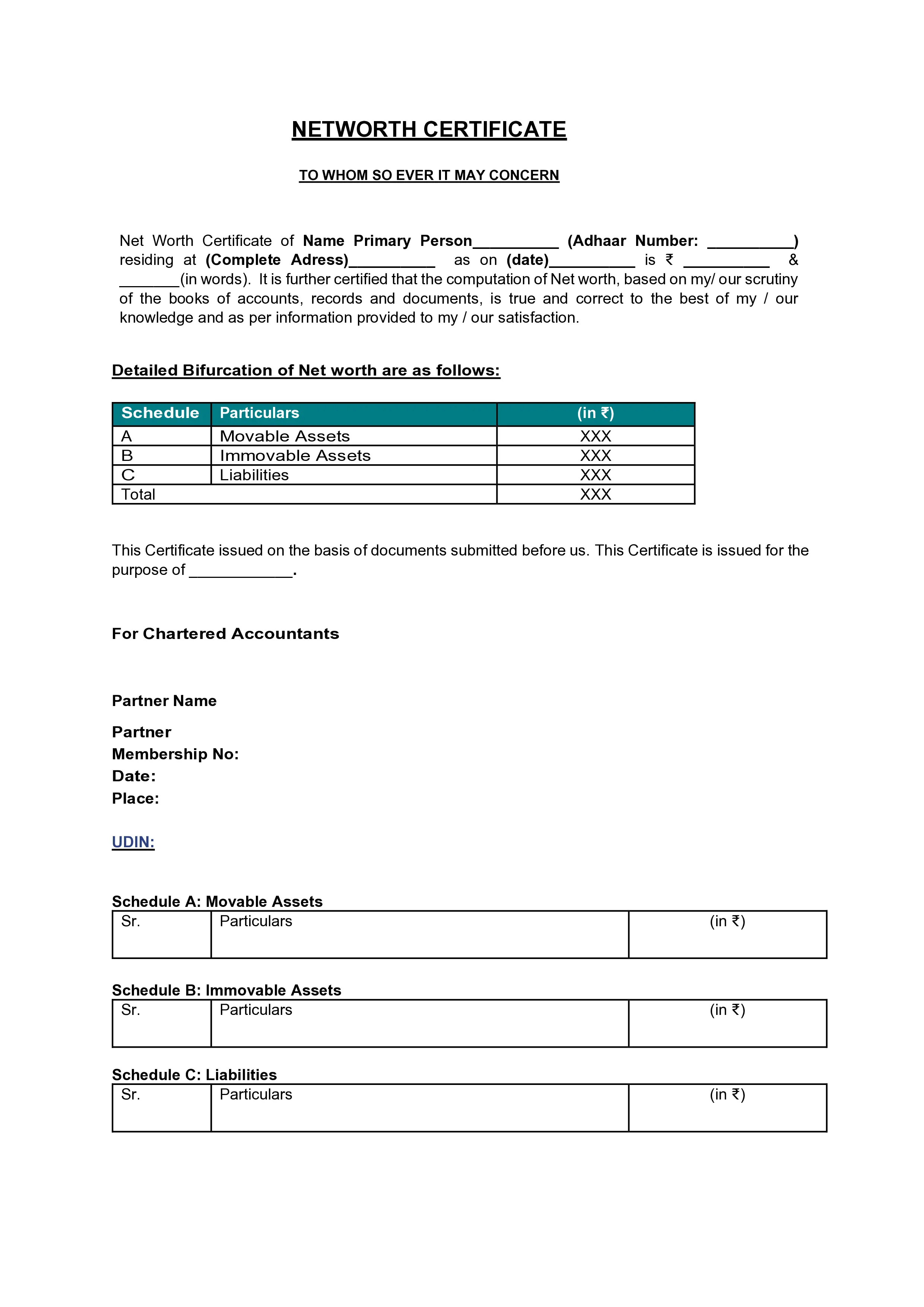

A networth certificate is a document which includes all the assets and liabilities of an individual. It shows the overall financial position of an individual or a company. The format of networth certificate includes the following details:

Make sure all the information provided by the applicant is valid and appropriate. Incase of any mistake or false information certificate can be canceled. The detailed format of networth certificate is as follow:

TO WHOM SO EVER IT MAY CONCERN

Net Worth Certificate of Name Primary Person__________ (Adhaar Number:__________) residing at ( Complete Adress)__________ as on (date)__________ is ₹ __________ & _______(in words). It is further certified that the computation of Net worth, based on my/ our scrutiny of the books of accounts, records and documents, is true and correct to the best of my / our knowledge and as per information provided to my / our satisfaction.

Detailed Bifurcation of Net worth are as follows:

|

Schedule |

Particulars |

(in ₹) |

|

A |

Movable Assets |

XXX |

|

B |

Immovable Assets |

XXX |

|

C |

Liabilities |

XXX |

|

Total |

XXX |

|

This Certificate issued on the basis of documents submitted before us. This Certificate is issued for the purpose of ____________.

For Chartered Accountants

Partner Name

Partner Signature

Membership No:

Date:

Place:

UDIN:

Schedule A: Movable Assets

|

Sr. |

Particulars |

(in ₹) |

Schedule B: Immovable Assets

|

Sr. |

Particulars |

(in ₹) |

Schedule C: Liabilities

|

Sr. |

Particulars |

(in ₹) |

Bizfoc offers a seamless solution for obtaining a CA-certified networth certificate for bank loan, simplifying the process for individuals or businesses with our experienced chartered accountant. We will guide you throughout the process in gathering documents and ensuring accuracy and compliance. Not only this our team will assist you after the process for post requirements.

Networth Certificate for bank loan required certain documentation. The fee for the certificate for bank loan is ₹2500/-. This is an essential document, one required for multiple purposes. It is needed for bank loans as it helps in calculating net worth, repay understanding, checking originality, etc. To obtain a networth certificate one needs to follow some steps. Bizfoc provides a hassle free procedure to obtain your certificate.

A Networth Certificate is a document required while applying for a loan or credit as it outlines all the assets and liabilities of an individual.

Networth Certificate for a bank loan is needed for calculating the net worth of an individual, understanding repayment capacity, checking originality, etc.

The fee of a networth certificate for a bank loan is ₹2500/- with Bizfoc.

A networth certificate for a bank loan can be certified by a chartered accountant.