A Turnover Certificate for tender is an essential document required by businesses participating in competitive bids or tender. This certificate provides a detail of the financial position of a business including its turnover or gross revenue for a specific period. It usually includes the last financial year. This certificate is needed by the tendering authorities or companies for a project as it shows their financial capacity for the execution of the work. This certificate can be certified by a CA. To get a better understanding related to CA Turnover Certificate read this article thoroughly.

Turnover Certificate for tender is a stamp approved by a Chartered Accountant to certifies the total turnover of an entity for a financial year. This certificate works as a proof that the organization has achieved the turnover amount mentioned in the certificate. It shows details of turnover based on either IncomeTax Return or GST returns or audit reports, as applicable. The duration of these certificates range from one year to multiple years, depending on your requirements. This certificate for tender helps in proving that the business has financial capacity, which is required for eligibility in competitive tenders especially for large-scale projects.

If you want a turnover certificate, you need to consult with a Chartered Accountant. Only a Chartered Accountant can issue and certify it. This certificate helps in ensuring credibility and accuracy. The certification for tender of this document is crucial to be considered valid by tendering authorities. Only authorized professionals with specific qualifications can certify this certificate.

For obtaining a Turnover Certificate for Tender one need to gather following information:

The fee for the Certificate for tender depends on the Chartered Accountant. However, it usually lies between the range of ₹1000/- to ₹2000/-. You can get your certificate for tenders with Bizfoc at the most affordable price compared to others. As we at Bizfoc believe client satisfaction is our motto so, we offer a turnover certificate for tenders at just ₹1499/-.

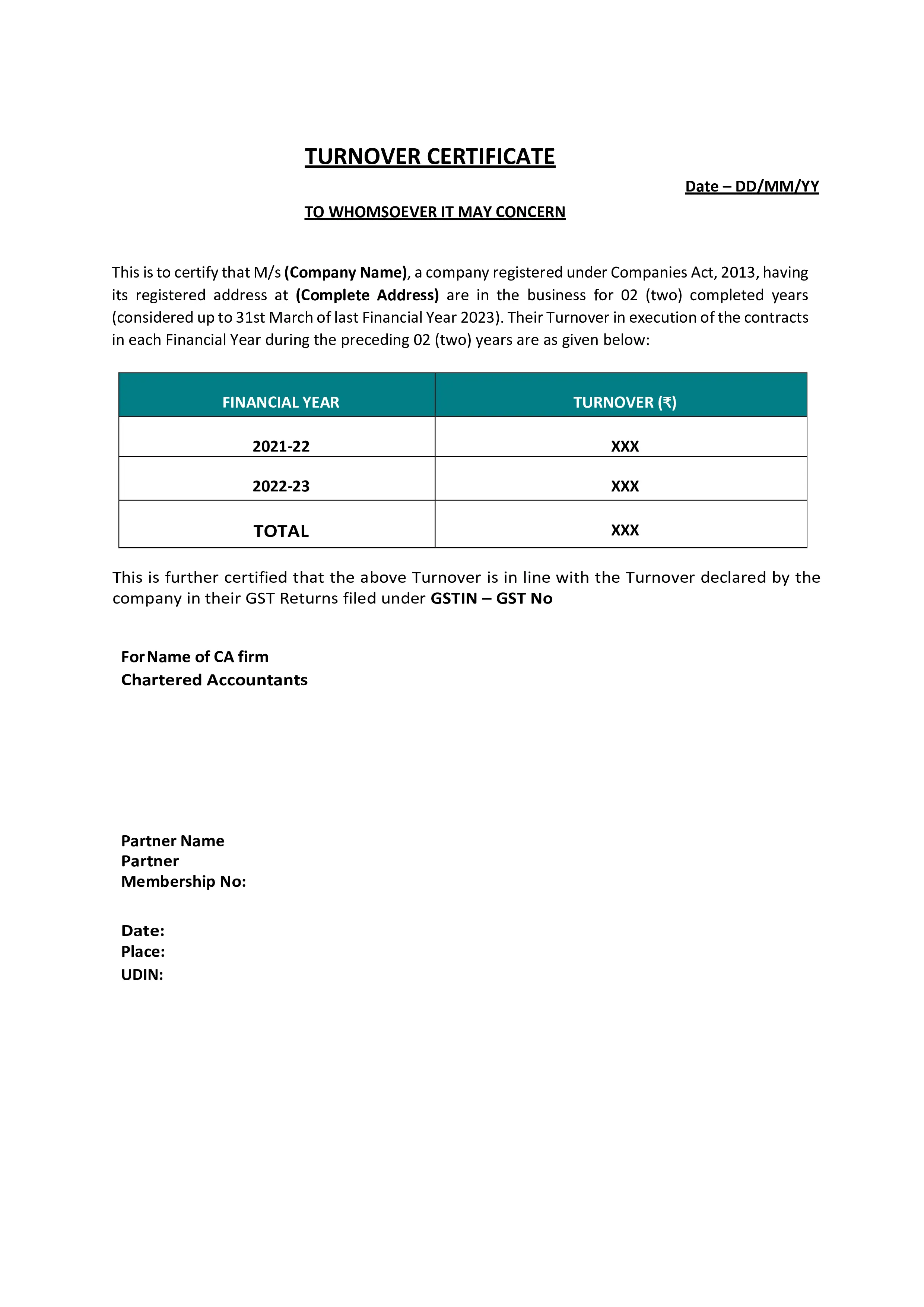

Following is the format for Turnover Certificate, you can read it in detail to get a better understanding related to it.

Date – DD/MM/YY

TO WHOMSOEVER IT MAY CONCERN

This is to certify that M/s (Company Name), a company registered under Companies Act, 2013, having its registered address at (Complete Address) are in the business for 02 (two) completed years (considered up to 31st March of last Financial Year 2023). Their Turnover in execution of the contracts in each Financial Year during the preceding 02 (two) years are as given below:

|

FINANCIAL YEAR |

TURNOVER (₹) |

|

2021-22 |

XXX |

|

2022-23 |

XXX |

|

TOTAL |

XXX |

This is further certified that the above Turnover is in line with the Turnover declared by the company in their GST Returns filed under GSTIN – GST No

For Name of CA firm

Chartered Accountants

Partner Name

Partner

Membership No:

Date:

Place:

UDIN:

To get a Turnover Certificate for tender from a qualified CA, one needs to follow certain steps. These steps ensure that the certificate is accurate and reflects the company’s true financial image. The steps to obtain the certificate for tenders are as follow:

For obtaining your certificate, you need to gather all the information as listed above. Bizfoc provides easy documentation for its clients.

After gathering all the required information, our Chartered Accountant will verify all the documents.

Once the documents are verified by our Chartered Accountant, a draft copy will be shared.

Once the draft is accepted, a final certificate copy is issued by a Chartered Accountant. At last, you will get your certificate.

Choosing a right service provider for obtaining a turnover certificate for tender is crucial, as the accuracy and timeliness of this document can directly affect your eligibility for tenders. At Bizfoc, we ensure that your experience is smooth, efficient, and tailored to meet your satisfaction. We offer this certificate for tender at just ₹1499/-. Consult with Bizfoc now!

The turnover certificate is a vital document for companies participating in tenders, as it shows the company's financial strength and capability. Ensuring accurate figures and obtaining a timely certificate can significantly improve your chance of winning a tender bid. You can get your certificate between ₹1000/- to ₹2000/- depending on the CA. This certificate is also required for various purposes such as while applying for a loan one needs a turnover certificate for a bank. To get your certificate for tender, consult with a qualified chartered accountant.

It is a document approved by a CA to certify the total turnover of an entity for a financial year.

The fee for the certificate for tender is just ₹1499/- with Bizfoc.

It can be issued only by a qualified Chartered Accountant.

The basic information required includes name and details of the business entity, period & purpose for it, UDIN, etc.