Networth Certificate for Partnership Firm or LLP is necessary for legal obligations, business transactions, insurance needs, and other reasons for partnership. In order to get your certificate, you need to hire a CA who can certify it. According to Companies Act, 2013, a partnership firm has at least 2 partners and a maximum of 50 partners. This certificate helps in maintaining transparency between partners of the firm. One can get this certificate within 24 hours. To get a better understanding, read this article thoroughly.

A Networth Certificate for Partnership Firm is an official document that showcases the financial health of partners at a specific period of time. This certificate outlines all the assets and liabilities after analyzing the book of accounts, investment details, and other records of partnership firms. To obtain your partnership certificate, you need to assign a qualified chartered accountant who will certify this certificate.

The main role of the certificate lies in gauging the financial health of partnership firms. Bizfoc provides this Certificate in just one day, certified by a qualified chartered accountant.

Here’s a list of documents required to obtain a Networth Certificate for Partnership Firm:

A networth certificate is a document which includes all the assets and liabilities of an individual. It shows the overall financial position of an individual or a company. The format of networth certificate includes the following details:

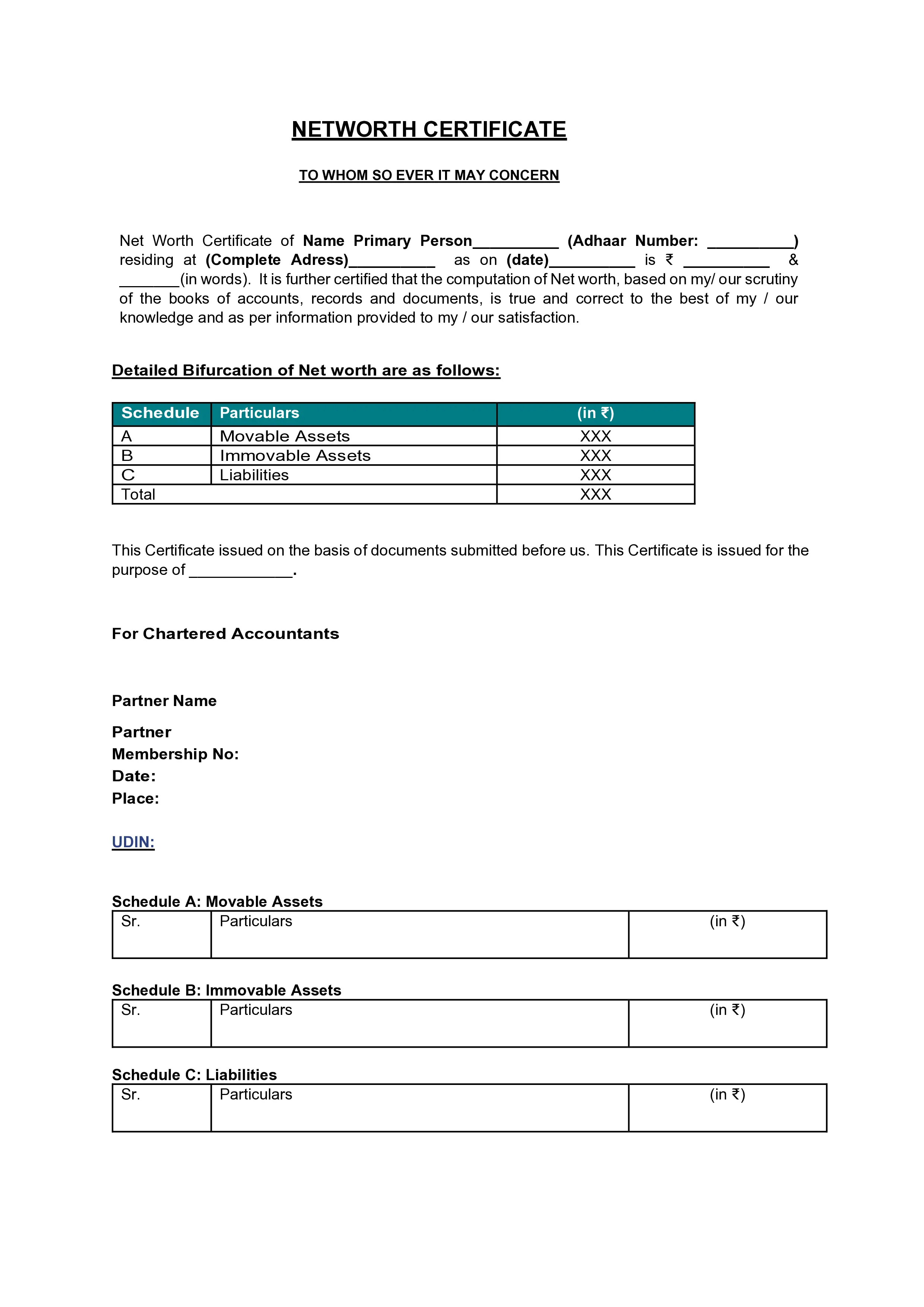

Make sure all the information provided by the applicant is valid and appropriate. Incase of any mistake or false information certificate can be canceled. The detailed format of networth certificate is as follow:

TO WHOM SO EVER IT MAY CONCERN

Net Worth Certificate of Name Primary Person__________ (Adhaar Number:__________) residing at ( Complete Adress)__________ as on (date)__________ is ₹ __________ & _______(in words). It is further certified that the computation of Net worth, based on my/ our scrutiny of the books of accounts, records and documents, is true and correct to the best of my / our knowledge and as per information provided to my / our satisfaction.

Detailed Bifurcation of Net worth are as follows:

|

Schedule |

Particulars |

(in ₹) |

|

A |

Movable Assets |

XXX |

|

B |

Immovable Assets |

XXX |

|

C |

Liabilities |

XXX |

|

Total |

XXX |

|

This Certificate issued on the basis of documents submitted before us. This Certificate is issued for the purpose of ____________.

For Chartered Accountants

Partner Name

Partner Signature

Membership No:

Date:

Place:

UDIN:

Schedule A: Movable Assets

|

Sr. |

Particulars |

(in ₹) |

Schedule B: Immovable Assets

|

Sr. |

Particulars |

(in ₹) |

Schedule C: Liabilities

|

Sr. |

Particulars |

(in ₹) |

At Bizfoc, we understand the value of money. We provide these Certificates at the most affordable price compared to others. Get your Networth Certificate for Partnership Firm at just ₹2500/-. It is required for various purposes such as while applying for loans or credit, visas, for legal proceedings, etc.

The very first step is to consult with a chartered accountant who can prepare this certificate. Bizfoc has a team of qualified chartered accountants.

Once you connect with Bizfoc, our CA will assist you in gathering your documents for further processing. They will make sure if all the documents are accurate and up-to-date or not.

Once you gather all the documents, you need to pay a fee for the certificate, and then our CA will review your application and documents.

Once the application is submitted, our CA will prepare and certify your networth certificate upon successful verification. After final verification, you’ll get your certificate.

Bizfoc offers a seamless solution for obtaining a Networth Certificate for Partnership Firm, simplifying the process with their experienced chartered accountant. They will guide you throughout the process in gathering documents and ensuring accuracy and compliance. Not only this, they will assist you after the process for post-requirements. Bizfoc has a remarkable image in certifying this certificate for partnership. We offer the most affordable price to our clients. Consult with Bizfoc now!

Networth Certificate for Partnership Firm is a document that outlines all the assets and liabilities of the firm. It presents the overall financial health of the applicant. It not only helps in maintaining transparency but also strengthens trust with stakeholders and financial institutions. The fee for the certificate is just ₹2500/-. By keeping your networth certificate up-to-date, you can make informed decisions. It also helps in sustainable growth and success for your Partnership business.

It is an official document that outlines all the assets and liabilities of the firm.

The fee for the certificate for Partnership is just ₹2500/-.

A networth certificate can be certified by a qualified chartered accountant.

It usually takes 24 hours to get your certificate for Partnership.