Networth Certificate of individual guarantor is an official document certified by a chartered accountant. It provides detailed information of assets and liabilities of an individual. It is typically required for financial and legal use where a person acts as a guarantor and he will repay the loan and credit in case of any default. This certificate presents the overall financial position of an individual. To get your certificate of individual guarantor you need certain documents and steps to follow. Bizfoc can assist you in the procedure of getting your certificate of individual guarantor. Read this article to learn about the procedure, fee structure, documentation, format, etc.

A guarantor is a person who guarantees to pay a borrower’s debt if they default on the loan obligation. They work as a guarantee on behalf of an individual. In other words, a guarantor involves helping someone else get credit, such as a loan or mortgage.

There are certain documents required for a double currency networth certificate. These documents includes:A networth certificate of individual guarantor is an essential document which shows all the assets and liabilities of the applicant. It presents the applicant's net worth without any misleading information. The role of guarantor is to work as a person who can repay the loan or credit in case of any default.

Bizfoc provides a guaranteed networth certificate of individual guarantor in just a single day. We charge ₹2500/- only as its fee. Our team will assist you throughout the process in document management.

To obtain a Networth Certificate for Individual, the following are the documents you require:

The fee for a Networth Certificate of individual guarantor is just ₹2500/-. One can get their certificate by paying this amount and fulfilling other documentation processes. However, this certificate is required for various purposes such as while applying for bank loan, visa, demat account opening, etc.

To apply for a Networth Certificate of individual guarantor, one need to follow these steps:

A networth certificate of an individual guarantor can be certified by a Chartered Accountant. No one other than that can issue this certificate. To get an authentic certificate, you should consult with a genuine personality. Bizfoc has a team of qualified Chartered Accountants. We provide excellent service in the field of networth certificates.

A networth certificate is a document which includes all the assets and liabilities of an individual. It shows the overall financial position of an individual or a company. The format of networth certificate includes the following details:

Make sure all the information provided by the applicant is valid and appropriate. Incase of any mistake or false information certificate can be canceled. The detailed format of networth certificate is as follow:

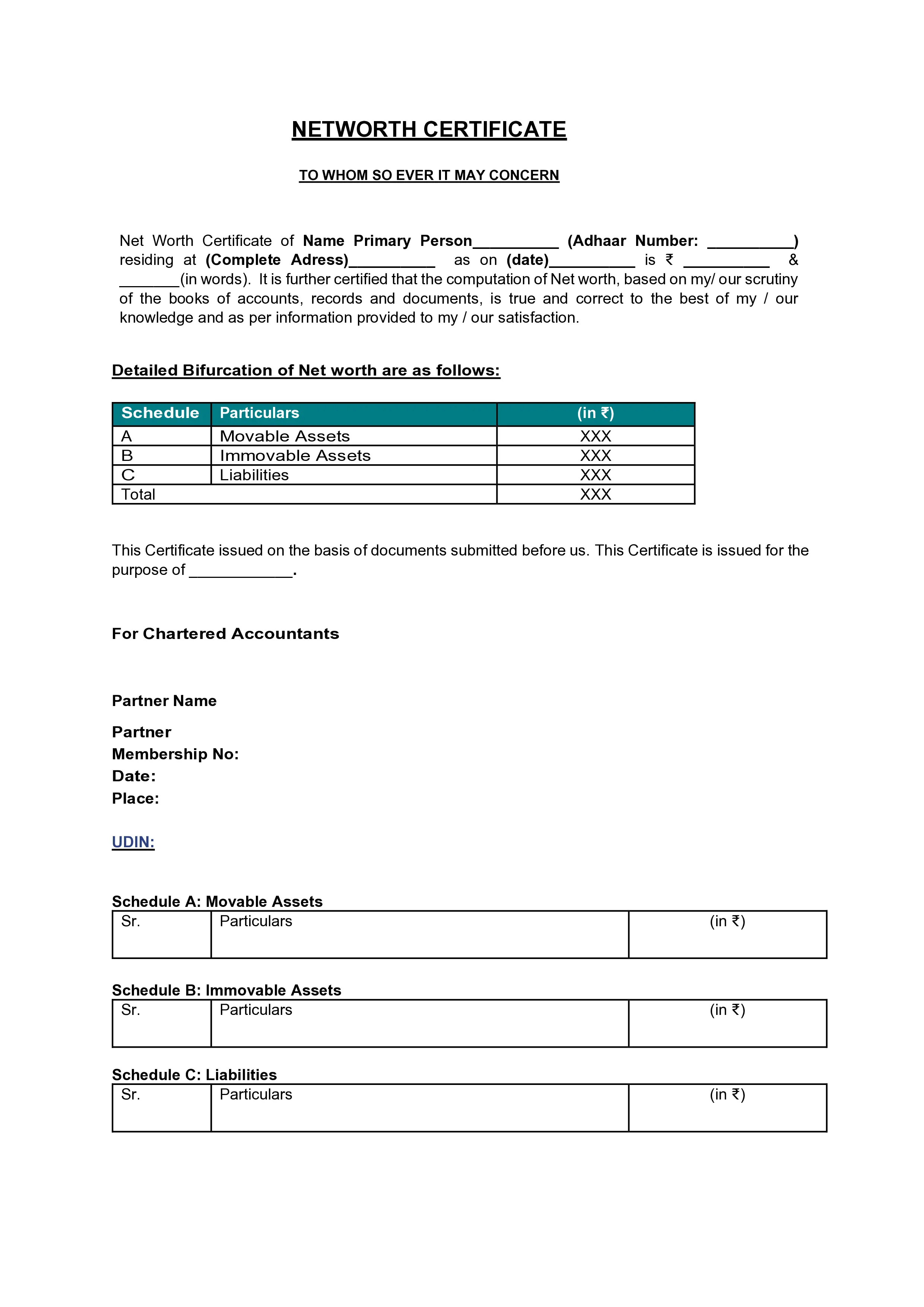

TO WHOM SO EVER IT MAY CONCERN

Net Worth Certificate of Name Primary Person__________ (Adhaar Number:__________) residing at ( Complete Adress)__________ as on (date)__________ is ₹ __________ & _______(in words). It is further certified that the computation of Net worth, based on my/ our scrutiny of the books of accounts, records and documents, is true and correct to the best of my / our knowledge and as per information provided to my / our satisfaction.

Detailed Bifurcation of Net worth are as follows:

|

Schedule |

Particulars |

(in ₹) |

(in foreign currency) |

|

A |

Movable Assets |

XXX |

XXX |

|

B |

Immovable Assets |

XXX |

XXX |

|

C |

Liabilities |

XXX |

XXX |

|

Total |

XXX |

XXX |

|

This Certificate issued on the basis of documents submitted before us. This Certificate is issued for the purpose of ____________.

For Chartered Accountants

Partner Name

Partner

Membership No:

Date:

Place:

UDIN:

Schedule A: Movable Assets

|

Sr. |

Particulars |

(in ₹) |

(in foreign currency) |

Schedule B: Immovable Assets

|

Sr. |

Particulars |

(in ₹) |

(in foreign currency) |

Schedule C: Liabilities

|

Sr. |

Particulars |

(in ₹) |

(in foreign currency) |

Bizfoc has multiple years of experience working in this field. We provide authentic certificates to our clients. We will support you and guide you during the whole process. We provide the best guaranteed and pocket friendly price for your certificate. Consult with us now to get your certificate within 24 hours.

Networth Certificate of individual guarantor is a document stating the financial condition of the applicant. It includes a person who can act as a guarantee in case of any default. This certificate includes documents such as applicant contact information, bank statement, property documents, investment records, balance sheet, etc. Not only this it also includes contact information of a guarantor. The fee for the certificate of individual guarantor is ₹2500/-. You can consult with a Chartered Accountant as only he can issue and certify the certificate. To get your certificate you can connect with Bizfoc.

It is an official document issued and certified by a chartered accountant that represents all the assets and liabilities of an individual.

Documents such as bank statements, investment records, balance sheets, personal information, guarantor contact details, etc. are required for a certificate.

A Networth Certificate of an Individual Guarantor costs ₹2500/- only with Bizfoc.

A Networth Certificate of an Individual Guarantor can be issued and certified by a Chartered Accountant only.

It takes 24 hours only to certify a Networth Certificate of an Individual Guarantor.

It can be calculated by subtracting total liabilities from total assets of an individual or a company.