A stock audit for precious metals is a systemic verification of high-value inventory involved in refining, trading, or mining of gold, silver, platinum, or other precious metals. This process is important to ensure inventory records' accuracy for jewelers, mines, retail outlets dealing with silver or gold, etc. By holding regular stock audit for precious metals, businesses can prevent fraud, ensure compliance with regulatory requirements, and enhance the efficiency of their operations. All businesses that deal with high-value inventory must conduct a stock audit of precious metals. BizFoc is a leading stock auditor for precious metals with a PAN India presence and over ten years of experience in inventory verification across different sectors.

Stock audit for precious metals refers to a systematic examination and verification of inventory related to valuable metals such as gold, silver, platinum, or other precious metals. This process is essential for businesses involved in the mining, refining, trading, and retailing of these valuable commodities. It ensures the recorded precious metal stock level matches the actual physical inventory on hand and helps identify any discrepancy in the stock. Conducting regular stock audits for precious metals helps maintain business operation efficiency, protect assets from theft, and safeguard profitability.

Many MSMEs conduct precious metal audits due to management requirements rather than regulatory requirements. The precious metal stock verification is carried out as prescribed under the Companies (Auditor's Report) Order, 2020, also known as CARO, 2020. The CARO, 2020 applies to the following organizations:

Public Listed Companies

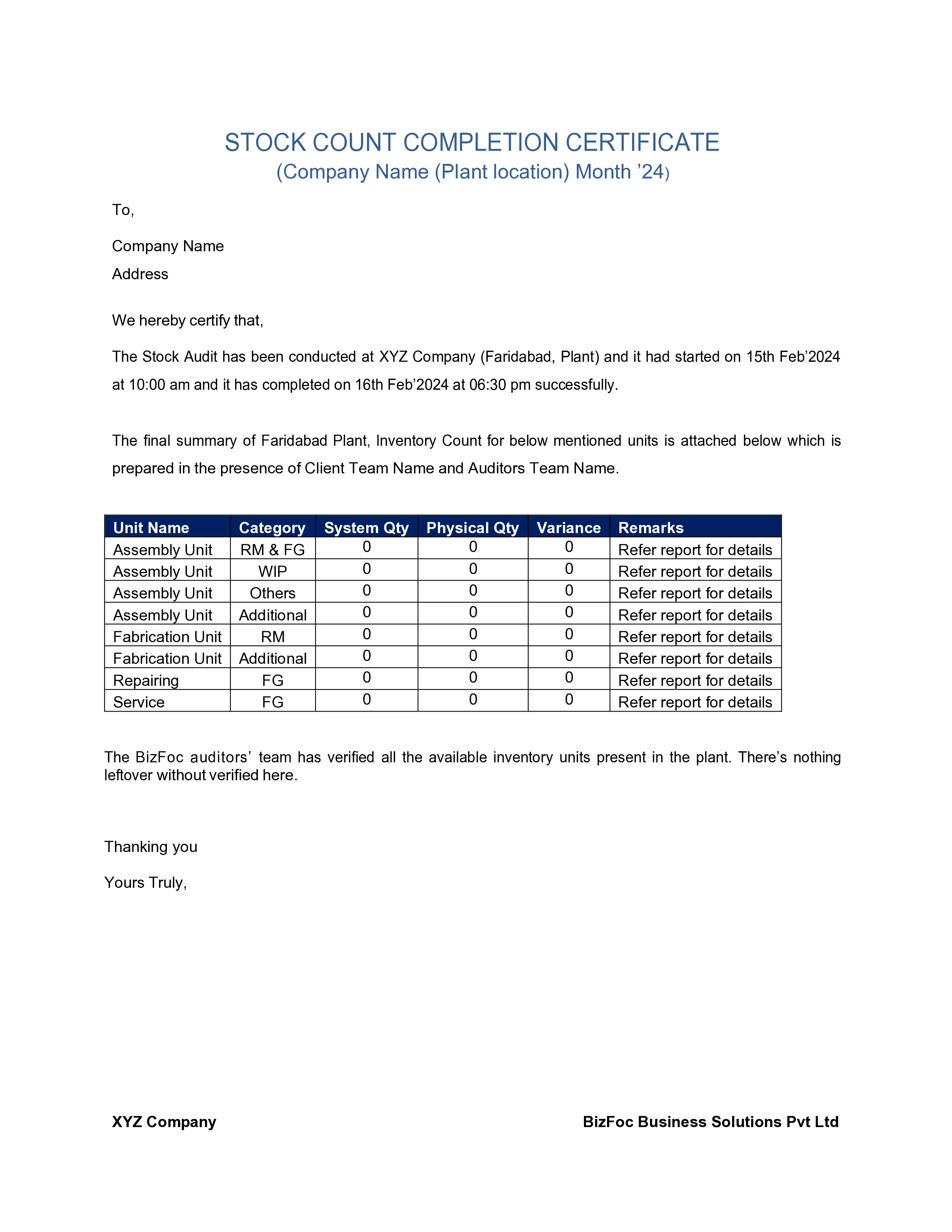

There is no standard format prescribed for the stock audit report for precious metals. Every business can have their format depending on the purpose of the audit. The auditor's report is usually accompanied by an Excel sheet for conducting any further analysis by the company. The report typically contains the following information:

There is comprehensive guidance on the process of precious metal audit which helps to conduct the audit properly:

It is necessary to know the auditing scope, types of inventories, locations, and specific items to be audited. A precious metal audit timeline must be set, considering the company’s function schedule.

To perform a physical count of the inventory stocks, one must use a systematic approach, like ABC analysis or cycle counting, to ensure comprehensive coverage, and discuss with the appropriate department for the counting process.

Compare the physical counts with the inventory, which has already been recorded. Write down the outcomes, investigate and reconcile irregularities, and document the reasons for variations after discussing them with the team on the ground.

Make a report of precious metal audit findings, which includes any irregularities and suggestions for enhancement. To give a summary record to high-level management, highlight key outcomes, and recommend appropriate actions.

Inventory audit checklist that is required to be followed for conducting an effective precious metal audit:

The fee for precious metal audit services in India can vary depending on various factors such as the number of SKU, night audit, location, days required, and inventory complexity. The stock audit fee starts from ₹2,499 per day, which excludes out of pocket costs and varies with the stock audit scope.

Here are some common challenges faced by the precious metal industry:

Bizfoc is a leading precious metal berification service provider firm in India with a presence in PAN India. The Bizfoc team has more than 10 years of experience in inventory audits, assisting companies like Tanishq and other Jewelers. Bizfoc provides best-in-class services at transparent pricing with a high degree of precision.

In conclusion, Stock audits for precious metals are important for organisations where significant money is invested in the inventory. Regular audits help to identify the dispensaries, maintain regulatory adherence, and prevent fraud. By implementing effective stock auditing can protect your valuable assets and foster stakeholder trust. It ensures the correctness of the stock recorded in the book of accounts and highlights any discrepancies like theft, slow-moving items, and supply chain issues related to the inventory of precious metals. Thus, a stock audit of precious metals helps improve the organisation's profit and loss.

A stock audit for precious metals is a systemic process of inventory arranged by businesses involved in the refining, trading, or mining of gold, silver, platinum, or other precious metals. This process is important to ensure the accuracy, integrity, and security of inventory records.

Stock audit is important for precious metals for several reasons:

Stock audits for precious metals are conducted by internal auditors, external auditing companies, or third-party auditors who have experience in precious metal inventories.

The business entity should leverage the expertise of stock auditors for precious metals with past credentials and a Pan India presence.