The stock audit in West Bengal is essential for different types of organizations which has significant working capital invested in the inventory. It helps to reconcile physical stocks with the stock recorded in the books of accounts. Any discrepancy needs to be investigated, as it might be due to damage, theft, or operational reasons. Additionally, banks require inventory verification to ensure sufficient stock value covers the loans provided to businesses. Therefore, it is crucial to conduct inventory audits at specified intervals, whether you run a retail store, e-commerce, manufacturing unit, franchise, or dealership. BizFoc is a leading stock auditor firm with a PAN India presence and over 10 years of experience in the inventory verification across different sectors.

A stock audit is also known as an inventory audit, which means physical verification of the quantity and value of stock with what is recorded in the books of accounts. The aim is to enhance the overall inventory management system by identifying potential risks, such as any misappropriation or damage and putting checks in place to ensure compliance with regulations. The inventory audit can include raw materials, work-in-progress, finished goods, and fixed assets. The inventory can be kept at different locations like retail stores, warehouses, Godown, manufacturing units, and franchise stores. The stock audit can be a blind count where stock is counted independently of what is recorded in the book of accounts. The stock audit involves suggesting best practices for improving stock management and recommending stock management software.

Many MSMEs conduct stock audits due to management requirements rather than the regulatory requirements. The stock verification is carried out as prescribed under the Companies (Auditor's Report) Order, 2020, also known as CARO, 2020. The CARO, 2020 is applicable to below the organisations.

The auditor needs to confirm on the following aspects related to the stock audit under CARO, 2020:

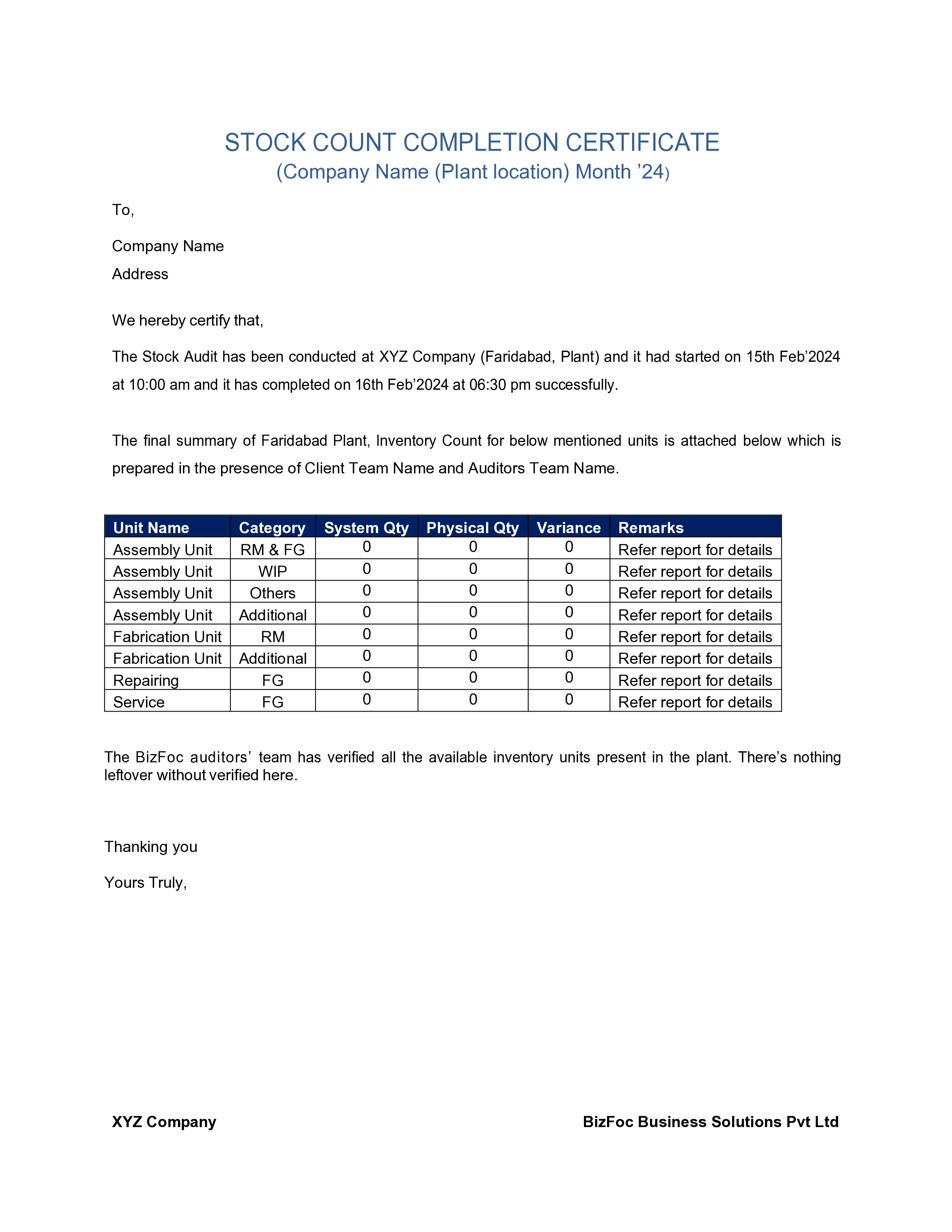

There is no standard format prescribed for the stock audit report. Every company can have their own format depending on the purpose of the audit. The auditor's report is usually accompanied by an Excel sheet for conducting any further analysis by the company. The report typically contains the following information:

There is a comprehensive guidance on the process of stock audit which help to conduct the audit properly:

It is necessary to know the auditing scope, types of inventories, locations, and specific items to be audited. Stock audit timeline must be set, taking into consideration the company’s function schedule.

To perform a physical count of the inventory stocks, one must use a systematic approach, like ABC analysis or cycle counting, to ensure comprehensive coverage, and discuss with the appropriate department for the counting process.

Compare the physical counts with the inventory, which is already recorded, write down the outcomes, investigate and reconcile irregularities, and document the reasons for variations post discussion with team on the ground.

Make a report of stock audit findings, which includes any irregularities, and suggestions for enhancement. To give a summary record to high-level management, highlight key outcomes, and recommend appropriate actions.

Inventory audit checklist that is required to be followed for conducting an effective stock audit:

The fee for stock audit services in West Bengal can vary depending on various factors such as the number of SKU, night audit, location, days required, and inventory complexity. The stock audit fee starts from ₹2,499 per man day, which exclude out of pocket cost and varies with the stock audit scope.

Bizfoc is a leading stock audit service provider firm in West Bengal with a PAN India presence. The Bizfoc team has more than 10 years of experience in inventory audits, assisting companies like Nykaa, Blinkit, and Asian Paints. Bizfoc provides best-in-class services at transparent pricing with a high degree of precision.

Stock audits are important for organizations where significant money is invested in the inventory. Organizations like manufacturing units, car dealers, franchisee retail stores, pharma companies, FMCG, and quick service restaurants deal with a lot of inventory, which makes auditing crucial. It ensures the correctness of the stock recorded in the book of accounts and highlights any discrepancies like theft, slow-moving items, and supply chain issues related to inventory. Thus, stock audits help to improve the profit and loss of the organizations.

Stock audit is physically checking the inventory counts against what is recorded in books of accounts. It ensures the accuracy of inventory recorded in the financials with what is physically present which is essential for presenting a true and fair view to the reader of the financial statement.

The primary reason to conduct a stock audit is to reconcile the physical stock with what is recorded in books and highlight any variances to the management.

Stock audit requirement is prescribed in CARO, 2020 where it is reported whether management has got the physical verification of the stock done. Some business entities get the stock audit done because of their internal requirement.

It depends on the scope of the audit. Usually, stock includes inventory. Fixed asset verifications are covered in stock audit in case it is part of stock audit.

The stock audit applicability on private companies in case any of the following limits is satisfied:

The stock audit is required due to regulatory requirement or required by banks due to working capital loan. Sometimes, management wants to conduct a stock audit to identify the variance of physical stock or recorded stock.

The stock audit needs an expert team who has experience in different sectors. Stock audit reconciles the physical stock with recorded stock.

The business entity leverages the expertise of the stock auditor with past credentials and Pan India's presence.

Businesses such as manufacturers, grocery stores, quick service restaurants, retail chains, franchisees, supply chain companies, and bank borrowers on working capital, which has significant money invested in stock, are recommended to have stock audits at regular intervals.

ZOHO and Tally are popular stock management softwares in India.